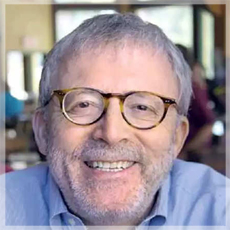

Peter Brandt is an American Forex and commodities trader. He worked as a broker for large industrial clients before founding Factor LLC in 1981 at the Chicago Board of Trade. Brandt is the author of Diary of a Professional Commodity Trader and Trading Commodity Futures with Classical Chart Patterns, both regarded as classics in the trading community.

Peter Brandt's Background

Born in 1947, Peter Brandt is a renowned American commodities and Forex trader known for his disciplined, pattern-based approach rooted in classical technical analysis. He emphasizes reading pure price action over relying on indicators or algorithms.

-

Early Career: Started as a broker servicing industrial clients, gaining deep knowledge of physical commodities markets.

-

Factor LLC (1981): Founded his trading firm at the Chicago Board of Trade, refining his focus on price patterns.

-

Shift to Proprietary Trading: Transitioned fully to trading based on chart patterns and market structure.

The Brandt Method: Simplicity and Discipline

-

“Trade What You See, Not What You Think”: Relies solely on classic chart patterns like head & shoulders, flags, and triangles—no moving averages or technical noise.

-

Risk Management: Limits risk to 1-2% per trade, using stop-losses tied to pattern invalidation.

-

Patience: Waits for high-probability setups, sometimes going weeks without trading, acknowledging "the market doesn’t owe you a trade."

Peter Brandt's Trading Tips

■ Managing risk matters the most

Gamblers obsess with big potential upside windfall profits. Intelligent speculators obsess with managing downside risk.

■ Charts do not predict the future, the only value in charts is for trade/risk management

I have made my living since 1975 trading futures markets using charts My conclusion on chart trading:

1. Charts do NOT predict prices

2. Most chart patterns fail

3. Charts simply tell us where a market has been

4. The only value in charts is for trade/risk management”

■ Your unrealized profits belong to the pot

Your unrealized profits belong to the pot, not to you. The only thing that counts is closed trade profits. This is why I track my trading based on sequential close trades.

■ Understand and analyze your mistakes

Make a mistake, analyze the mistake, understand the mistake, then get over it and focus on the next trade in the ongoing series of trades

■ Holding a profitable position to back up your opinion is a difficult task

Having an opinion on a market is cheap and easy. Establishing and holding a profitable position to back up an opinion — this is where trading gets tricky.

■ We have no control over markets

Amateur traders ask whether a market is going up or down. This is the wrong focus. We have no control over markets. None. Our only focus should be what orders do we need to have resting in the market. Trading is not glamorous. A trader is simply a clerical order enterer.

■ Stop being obsessed with catching tops and bottoms

My advice to young traders who want long trading careers: Stop being obsessed with catching tops and bottoms and become willing to accept large chunks in the middle.

■ When you are wrong, your position will always be too large

When you are right, your position will never be large enough. When you are wrong, your position will always be too large.

■ Minimum conditions to become a full-time trader

If you desire to become a full-time trader, the following are what I believe to be the minimum conditions:

1. Your trading account should represent profits you have accumulated from the markets, not savings you have taken from some other endeavor

2. Your account size should be at least three to four times greater than the amount of annual profits you are expecting to make from trading

3. You should have at least two years of savings in the bank (other than your trading capital) to cover your living expenses. Depending on trading profits to cover living expenses is a very poor place to start

4. You should have been profitable the last two consecutive years with Calmar and Gain-to-Pain ratios of at least 1.5 to 1

5. You should have a complete understanding of the trading plan you will begin using

6. You should assume a 50% chance that your first year will be a losing year

■ Peter L. Brandt (Forex and commodity trader)

Forex-Investors.com (c)

|

TWITTER: |

» @PeterLBrandt |

|

LINKEDIN: |

» Peter Brandt (Factor LLC) |

|

BOOKS: |

» Peter Brandt on Google Books |

THE ADVICE OF PROS: □ Forex Traders: » Bill Lipschutz | » Michael Marcus | » Randy McKay | » Stanley Druckenmiller | » Paul T. Jones | » Andrew Krieger □ Macro Traders: » Bruce Kovner | » Colm O’ Shea | » Louis Bacon | » Ray Dalio □ Systematic Traders: » Ed Seykota | » James Simons | » Larry Hite □ Hedge Fund Managers: » David Tepper | » William Eckhardt | » Monroe Trout | » John Paulson | » Joe Vidich | » Warren Buffet □ Iconic Investors: » Jesse Livermore | » William D. Gann | » Napoleon Hill | » George Soros | » Peter Lynch | » Marty Zweig □ Derivatives Traders: » Richard Dennis | » Peter L. Brandt | » Victor Sperandeo | » Linda Raschke | » Nassim Taleb □ Find More: » Brokers Directory | » Automated Trading Systems