Raymond Thomas Dalio is an American billionaire hedge fund manager. He began his career on the floor of the New York Stock Exchange, trading commodity futures. In 1975, he founded Bridgewater Associates, which became the world’s largest hedge fund by 2005.

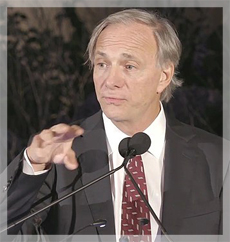

Ray Dalio's Background

Born in 1949, Ray Dalio is a billionaire investor, hedge fund pioneer, and economic philosopher, best known as the founder of Bridgewater Associates—the world’s largest hedge fund. From humble beginnings trading commodities in his apartment, he built a $150B+ powerhouse that redefined institutional investing.

-

Early Career: Started on the NYSE floor, gaining firsthand experience in markets and trading psychology.

-

Bridgewater’s Launch: Founded in 1975, initially advising corporations on risk before evolving into a global macro fund.

-

Innovation: Created systematic, principles-based frameworks blending fundamental research with algorithmic precision.

The Dalio Playbook

-

All-Weather Portfolio (1996): A risk-parity strategy built to thrive in all economic climates—balancing asset classes by volatility, not just capital.

-

Economic Machine Theory: Dalio’s signature explainer on debt cycles, central banking, and productivity—core to Bridgewater’s macro models.

-

Radical Transparency: Bridgewater's famously candid culture values truth over comfort—using recorded meetings and issue logs to drive learning.

Performance

-

2008: While markets crashed, Bridgewater’s Pure Alpha fund gained 9.5%.

-

2010: Anticipated Europe’s debt crisis and shorted the euro.

-

2020: All-Weather portfolio outperformed the classic 60/40 mix during COVID turmoil.

Books & Legacy

-

Net Worth: Estimated $18.4B (2020, Bloomberg).

-

Books:

-

Principles (2017): A guide to life, work, and decision-making.

-

The Changing World Order (2021): A macro view of shifting global powers.

-

Ray Dalio's Investing Tips

■ Two main drivers of asset class returns

There are two main drivers of asset class returns - inflation and growth.

- When growth is slower than expected, stocks go down

- When inflation is higher than expected, bonds go down. When inflation is lower than expected, bonds go up

■ Demand is best measured in terms of spending

Demand is best measured in terms of spending. You know, I think in traditional economics, it's a mistake to measure it in terms of the quantity of goods.

■ Diversify your portfolio

Know how to diversify into non-cash assets like stocks, bonds, and real estate. You need to diversify by holding assets that will do well in either a rising or a falling growth environment, or a rising or falling inflation environment and should diversify by holding international as well as domestic asset classes.

■ if you deviate, learn how to play the market’s long-term cycles

If you deviate from that balanced mix — which I don’t recommend doing because market timing is a tough game for a non-professional and for professionals to play well — know how to play the cycles

■ Be contrarian to the masses (bet against the consensus)

Know how to buy when everyone else wants to sell, and how to you sell when everyone else wants to buy.

-In order to be successful, you're betting against the consensus, and you have to be right.

-The consensus is built into the price. So because the consensus is built into the price, and assets price themselves in a way that they're all competing, and they're all of equal value in a certain sense. There's risk premium of equities over cash and bonds will have that over whatever, but basically, they're all priced that way. So like think of it as going to betting on a sports team or in other words, or horse racing.

-The biggest mistake that most people make is to judge what will be good by what has been good lately. So if a market has gone up a lot, they think that’s a good market rather than it’s more expensive. And when it goes down a lot over the last few years, they think, ‘That’s a bad market, and I don’t want any of it'.

■ The average man is wrong

The average man tends to be much more reactive if you look at the purchases and sales that they make. When something goes up, they're more likely to buy it. They think, ah, that's a good investment. They don't know how to measure that in terms of, oh, is that a much more expensive investment that's more likely to go down?

-That's what they're attracted to. They tend to buy high and sell low, and so an average man should not be playing this game in that way.

■ Cash is a bad investment

Cash is not going to be a good investment. In relation to inflation, it'll probably lose 2% a year and maybe more.

■ Own some gold

I think you have to have a little bit of gold in your portfolio.

■ Be Realistic

To be effective you must not let your need to be right be more important than your need to find out what’s true.

-The more you think you know, the more closed-minded you’ll be.

■ An accurate understanding of reality is essential for producing good outcomes

Truth - more precisely, an accurate understanding of reality - is the essential foundation for producing good outcomes.

-Success is achieved by people who deeply understand reality and know how to use it to get what they want. The converse is also true: idealists who are not well-grounded in reality create problems, not progress.

■ Savings equals freedom and security

Ask yourself, ‘How long can I get by on my savings without having any income? How many months or how many years of freedom and safety do I need?’ and make sure that you have more than that.

■ Asking the right questions matters more than having great answers

Look for people who have lots of great questions. Smart people are the ones who ask the most thoughtful questions, as opposed to thinking they have all the answers. Great questions are a much better indicator of future success than great answers.

■ Don’t mistake possibilities for probabilities

Anything is possible. It’s the probabilities that matter. Everything must be weighed in terms of its likelihood and prioritized.Believe it or not, your pain will fade and you will have many other opportunities ahead of you.

■ Logic vs emotions

There are two broad approaches to decision making: evidence/logic-based (which comes from the higher-level brain) and subconscious/emotion-based (which comes from the lower-level animal brain).

-Not being controlled by an emotion helps to see things at a higher level.

■ To fail is to learn

What's the risk of failure? What, you'll be embarrassed? How do you distinguish failure from learning? If it's part of a 'You're failing and then you learn,' then that learning is part of the moving forward. So that is what the process is like. Fail, learn, move forward.

-Mistakes are the path to progress.

-If you’re not failing, you’re not pushing your limits, and if you’re not pushing your limits, you’re not maximizing your potential.

-The challenges you face will test and strengthen you.

■ Keep a track record to know where you are wrong

The main reason I write the daily observations is because I want to know where I'm wrong.

■ Meditation is part of your success

Transcendental meditation (TM) has probably been the single most important reason for whatever success I've had.

■ Focus on Big things

It’s more important to do big things well than to do the small things perfectly.

■ Ray Dalio (Hedge Fund Manager)

Forex-Investors.com (c)

|

TWITTER: |

» @RayDalio |

|

LINKEDIN: |

» linkedin.com/in/raydalio |

|

BOOKS:

|

» Ray Dalio on Google Books |

| » Ray Dalio on Amazon |

THE ADVICE OF PROS: □ Forex Traders: » Bill Lipschutz | » Michael Marcus | » Randy McKay | » Stanley Druckenmiller | » Paul T. Jones | » Andrew Krieger □ Macro Traders: » Bruce Kovner | » Colm O’ Shea | » Louis Bacon | » Ray Dalio □ Systematic Traders: » Ed Seykota | » James Simons | » Larry Hite □ Hedge Fund Managers: » David Tepper | » William Eckhardt | » Monroe Trout | » John Paulson | » Joe Vidich | » Warren Buffet □ Iconic Investors: » Jesse Livermore | » William D. Gann | » Napoleon Hill | » George Soros | » Peter Lynch | » Marty Zweig □ Derivatives Traders: » Richard Dennis | » Peter L. Brandt | » Victor Sperandeo | » Linda Raschke | » Nassim Taleb □ Find More: » Brokers Directory | » Automated Trading Systems