The History of the World’s Exchange Rates

The varied valuations of world currencies have created the need for trading and hedging against market risk. The Foreign Exchange Market serves as a global platform for exchanging different currencies. Below is a brief history of the world’s exchange rates.

The varied valuations of world currencies have created the need for trading and hedging against market risk. The Foreign Exchange Market serves as a global platform for exchanging different currencies. Below is a brief history of the world’s exchange rates.

Currencies that Dominated the World

The 5th century B.C. silver drachma of Athens was likely the first currency accepted beyond its issuing state. Since then, gold has been the only true global currency. The Greek drachma was followed by the Roman gold Aureus and silver Denarius, which remained in use until the early 4th century A.D. Afterwards, the Byzantine gold Solidus became dominant, followed by the Islamic Dinar. In the 13th century, the Florentine Fiorino rose to prominence in the Mediterranean, succeeded by the Venetian Ducato in the 15th century. Later, the Spanish Dollar was widely used in Europe, the Americas, and the Far East, and became the first world currency by the 16th century. During the 17th century, the Dutch Guilder was the world’s leading currency. Following that period, and until World War II, the British Pound Sterling was the most widely accepted currency globally. Since WWII, the dominance of the US Dollar has been undisputed.

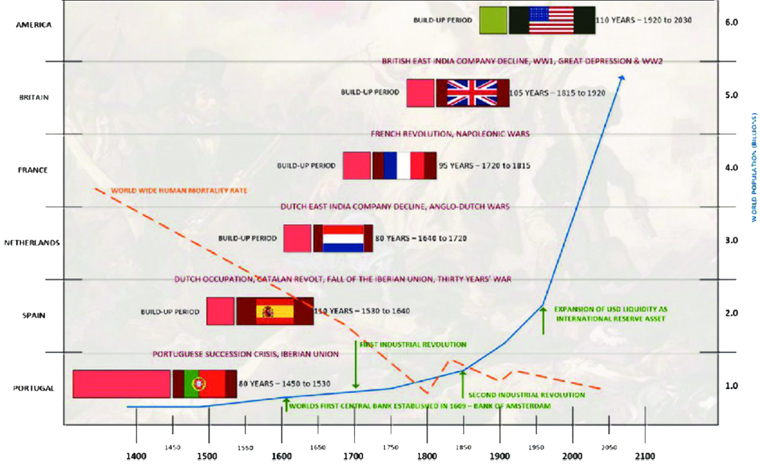

Image: Historical Timeline of Global Reserve Currencies

Source: 2024 BRICS Journal of Economics (A New Paradigm in Global Finance – Exploring the Potential of a Global Reserve Currency)

The Modern History of Exchange Rates

This is a brief history of modern exchange rates, spanning from the 1944 Bretton Woods Agreement to major currency market crises.

The Bretton Woods Agreement (1944-1971)

The Bretton Woods Agreement, signed in July 1944, established the world’s first globally accepted monetary order. The system was agreed upon by the United States, Western European countries, Japan, Canada, and Australia, among a total of 44 participating nations. The agreement imposed a series of monetary obligations on all parties.

-

July 1944: The Bretton Woods Agreement establishes a fixed exchange rate system where major currencies are pegged to the US dollar, and the dollar is convertible to gold at $35/ounce

-

1958: European currencies become fully convertible, facilitating international trade

-

1960s: Growing US deficits and inflation strain the system, leading to doubts about dollar-gold convertibility

Other Facts Regarding the Bretton Woods Agreement

-

The United States anchored the new monetary system to gold and the US dollar, as it controlled two-thirds of the world’s gold reserves at the time.

-

The Soviet Union attended the conference but ultimately declined to join the agreement.

-

All participants agreed to peg their currencies to gold.

-

All agreed to avoid deliberate devaluation of their currencies.

-

Two key institutions were established: (i) the International Monetary Fund (IMF) and (ii) the International Bank for Reconstruction and Development (IBRD).

-

The IMF was empowered to adjust temporary payment imbalances among countries.

The Termination of the Bretton Woods Agreement (1971-1973)

In August 1971, the US ended the agreement by stopping the convertibility of the US dollar into gold. Other countries soon followed, abandoning the fixed-currency system in favor of free-floating exchange rates. After the Bretton Woods system ended, the values of major world currencies began to fluctuate more freely, increasing the demand for foreign exchange services and brokerage.

-

August 15, 1971: US President Nixon suspends gold convertibility ("Nixon Shock"), ending the Bretton Woods system.

-

December 1971: Smithsonian Agreement adjusts currency pegs but fails to stabilize the system.

-

1973: Major currencies transition to floating exchange rates, ending fixed rates.

Floating Rates & Volatility (1970s–1980s)

After the end of the Bretton Woods Agreement, global exchange rates shifted to the current system of free-floating rates.

-

1973–1974: Oil crisis causes currency volatility; USD weakens due to inflation.

-

1976: Jamaica Agreement formalizes floating exchange rates under IMF rules.

-

1980–1985: Strong USD due to Fed’s high-interest rates (Volcker Shock).

-

1985: Plaza Accord (Sept. 22) – G5 nations intervene to weaken the USD.

-

1987: Louvre Accord (Feb.) attempts to stabilize exchange rates.

The Birth of the European Currency (1992-2002)

On January 1, 1999, the Euro became the common currency of the European Union member states. All national currencies were replaced by a single currency, primarily linked to the German Mark. Member states transferred their monetary policy authority to the European System of Central Banks (ESCB), while the Council of Ministers took charge of the euro area’s exchange-rate policy.

-

1992: Maastricht Treaty sets the stage for the euro.

-

September 1992: Black Wednesday – UK pound crashes out of the ERM.

-

1999: Euro introduced electronically (EUR/USD launches at ~1.18).

-

2002: Euro notes and coins enter circulation.

Exchange Rates Crises (1990s–2025)

-

1994: Mexican Peso Collapse (December)

-

1997–1998: Asian Financial Crisis – Thai baht, Indonesian rupiah, and others crash

-

1998: Russian Ruble Crisis (August) – Country default and Ruble's devaluation

-

1999: Brazilian Real devaluation (January)

-

2001: Argentine Peso Crisis – Peg to USD was abandoned

-

2002–2008: Commodity-driven currencies strengthen (AUD, CAD)

-

2008: Global Financial Crisis – USD surges and EUR/USD drops from 1.60 to 1.25

-

2010–2012: Eurozone Debt Crisis – EUR weakens amid Greek, Irish, and Spanish debt crises

-

2015: Swiss Franc Shock (Jan. 15) – CHF soars after SNB abands EUR/CHF peg

-

2016: Brexit Vote (June 23) – GBP falls from 1.50 to 1.30 vs. USD

-

2020: COVID-19 Pandemic – USD initially surges, then weakens due to Fed stimulus

-

2022: Russia-Ukraine War – Sanctions disrupt RUB while EUR weakens on energy crisis

The Roots Behind the Names of the World’s Currencies

-

Dollars

According to OxfordWords, the word “Dollar” originates from the German word Joachimsthal. A large amount of silver was mined in Joachim’s valley, and the silver coins produced there were called “Joachimsthaler” coins. Over time, this was shortened to “thaler” and eventually became “dollar.”

-

Euros

The Euro is named after Europa, a Cretan queen from Greek mythology. The name’s etymology derives from the Greek word eurys, meaning “wide.”

-

Chinese Yuan

The Chinese Yuan means “round coin.”

-

British Pound Sterling

The Pound derives from the Latin word Poundus, meaning “weight.”

-

Gold

The word “Gold” has Gothic origins. The Gothic word Gulþa evolved into Geolu, meaning “yellow.” The term “Gold” became widespread in the 12th century.

■ The History of the World’s Exchange Rates

Forex-investors (c)

□ More on Forex: » Getting Started | » Forex Investing | » Exchange Rates History | » Forex Risks | » Forex Regulation □ Find More: » Brokers Directory | » Automated Trading Systems